State Bank of Pakistan Loan Scheme 2025: Apply Online, Eligibility & Key Benefits

Introduction: A Big Boost for Pakistan’s Entrepreneurs

State Bank of Pakistan Loan Scheme 2025 is opening new doors for Pakistan’s young entrepreneurs, small business owners, and professionals. Through this government-backed program, applicants can secure affordable business financing to start or expand their ventures — promoting innovation, employment, and financial inclusion across the country. By offering loans between Rs. 20 lakh and Rs. 35 lakh at subsidized markup rates, the initiative aims to reduce financial barriers for startups and empower individuals to build sustainable businesses.

Purpose of the SBP Loan Scheme 2025

The goal behind this program is to make low-cost business loans accessible for people with potential, ideas, and passion but limited financial means. The scheme focuses on encouraging youth entrepreneurship and self-employment, supporting women-led startups and small businesses, strengthening SMEs, agriculture, and service sectors, and promoting inclusive growth and financial independence. By bridging the financing gap, the SBP Loan Scheme 2025 is paving the way for a more vibrant and job-generating economy.

Also Read: Pink Scooty Scheme 2025

Key Features of the State Bank Loan Scheme

Loan Amount & Purpose

Eligible applicants can avail loans ranging from Rs. 2 million to Rs. 3.5 million, which can be used for launching a new business, expanding an existing one, buying equipment or machinery, or investing in agriculture, manufacturing, and services. This flexibility allows entrepreneurs to tailor the loan according to their business goals.

Low Markup & Easy Repayment

The scheme offers subsidized interest rates under SBP’s youth financing policy. Tenure: 3 to 8 years. Grace Period: Available for eligible projects. This structure ensures entrepreneurs can manage repayments smoothly without overwhelming financial pressure.

Simple & Inclusive Eligibility

Anyone meeting the following basic criteria can apply: Pakistani citizen aged 21–45 years, valid CNIC, a feasible business plan or proposal, and proof of financial capacity to repay. Applicants from urban, rural, and semi-urban areas are all eligible, ensuring equal access across Pakistan.

Collateral-Free Loans for Small Borrowers

One of the standout features of this initiative is the no-collateral policy for smaller loans. Young professionals and women entrepreneurs can obtain unsecured financing under government-backed guarantees, reducing the burden of providing security or property pledges.

Partner Banks and Financial Institutions

The program is available through leading commercial and microfinance banks regulated by SBP, including:

- National Bank of Pakistan (NBP)

- Habib Bank Limited (HBL)

- Bank of Punjab (BOP)

- Meezan Bank (Islamic financing option)

- Khushhali Microfinance Bank

This network ensures accessibility, transparency, and quick loan processing across Pakistan.

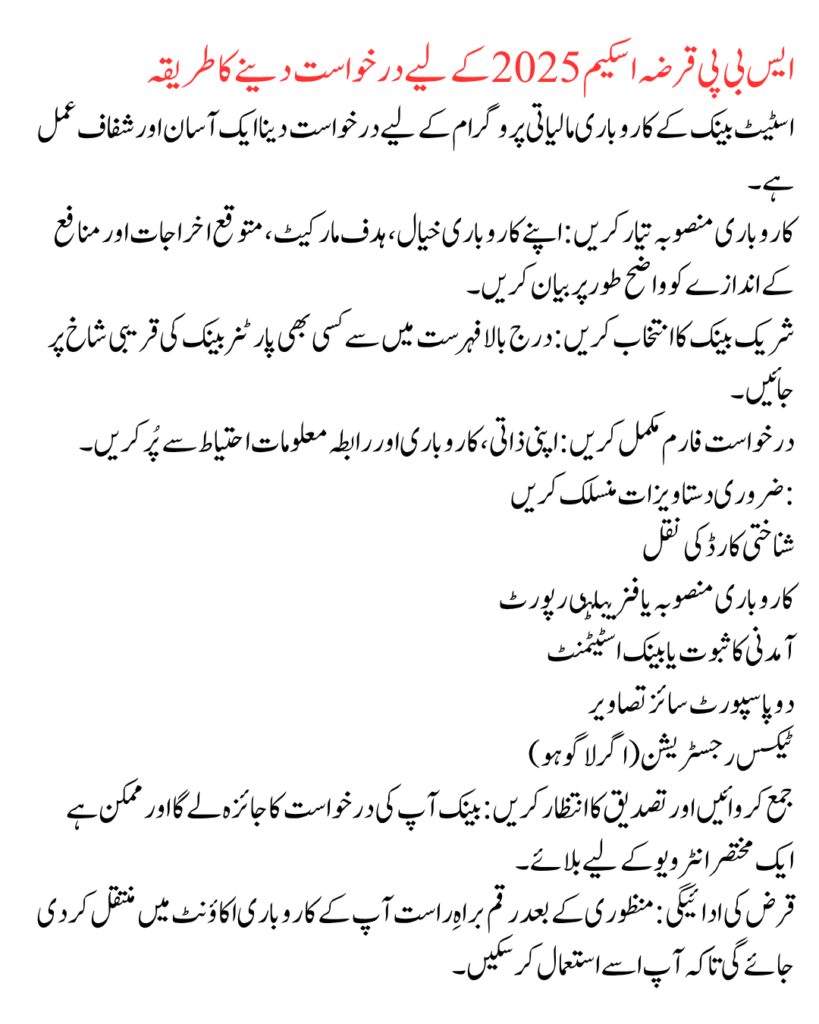

How to Apply for the SBP Loan Scheme 2025

Applying for the State Bank’s business financing program is simple and transparent.

- Prepare a Business Plan: Clearly outline your idea, target market, estimated costs, and profit projections.

- Select a Participating Bank: Visit your nearest branch of any partner bank listed above.

- Complete the Application Form: Fill in your personal, business, and contact details carefully.

- Attach Required Documents:

- CNIC copy

- Business plan or feasibility report

- Proof of income or bank statement

- Two passport-size photographs

- Tax registration (if applicable)

- Submit and Await Verification: The bank will review your proposal and may schedule a short interview.

- Loan Disbursement: Upon approval, the funds are transferred directly to your business account for use.

5 Major Benefits of the SBP Loan Scheme

| Benefit | Description |

|---|---|

| Promotes Entrepreneurship | Helps young and small business owners launch or expand startups. |

| Affordable Financing | Low markup rates make borrowing cost-effective and sustainable. |

| Women Empowerment | Dedicated quota for women entrepreneurs and small business owners. |

| Job Creation | Drives employment and boosts skill development across sectors. |

| Transparent Process | Government-backed system ensures fairness and accountability. |

Who Can Apply?

The scheme welcomes young entrepreneurs starting new ventures, existing business owners expanding operations, women-led enterprises and freelancers, agriculture professionals, and tech-based startups. From small workshops to digital agencies and agribusinesses, the SBP Loan Scheme provides the foundation every idea needs to grow.

Required Documents Checklist

Keep these documents ready before applying to speed up approval:

- Valid CNIC

- Two passport-size photographs

- Business plan or feasibility study

- Bank statement or income proof

- Tax registration certificate (if applicable)

- Collateral or guarantor details (for larger loans)

Why This Scheme Matters for Pakistan

The SBP Loan Scheme 2025 plays a key role in driving Pakistan’s economic transformation. By supporting startups, SMEs, and women-led ventures, it encourages self-reliance and job creation — vital components of sustainable growth. This initiative reduces dependency on traditional employment, inspires innovation, and ensures that every skilled Pakistani has access to financial opportunities. It aligns with the country’s vision for inclusive development and entrepreneurship-driven growth.

FAQs – State Bank of Pakistan Loan Scheme 2025

Q1. Who can apply?

Any Pakistani citizen aged 21–45 years with a valid CNIC and a practical business plan.

Q2. What is the loan range?

Loans are available from Rs. 20 lakh to Rs. 35 lakh, depending on eligibility and business requirements.

Q3. Do I need collateral?

Not always. Small loans and startup applicants can apply without collateral under government guarantee.

Q4. What’s the repayment period?

You can repay the loan within 3 to 8 years through easy monthly installments.

Q5. Where can I apply?

Apply through participating banks such as NBP, HBL, BOP, Meezan Bank, or Khushhali Microfinance Bank.

Conclusion: Empowering Pakistan’s Next Generation of Entrepreneurs

The State Bank of Pakistan Loan Scheme 2025 is not just a financing initiative — it’s a pathway to self-reliance and innovation. By combining low-interest business loans, simple eligibility, and collateral-free access, the SBP is helping thousands of Pakistanis turn their ideas into thriving businesses. If you have the vision and the plan, this is your moment. Visit your nearest participating bank today and take the first step toward building your dream business and contributing to Pakistan’s economic future.

SEO & Publishing Details

SEO Title:

State Bank Loan Scheme 2025 – Apply Online Now

Meta Description:

Apply for the SBP Loan Scheme 2025. Get business loans up to Rs. 3.5 million with low markup and easy installments. Open for youth, women, and SMEs.

Target Keywords:

- State Bank Loan Scheme 2025

- SBP Business Loan Pakistan

- Apply Online SBP Loan

- Youth Business Financing 2025

- Women Entrepreneur Loan Pakistan

Featured Image Idea:

A young entrepreneur in Pakistan holding business documents outside a bank, symbolizing opportunity and empowerment — with SBP’s logo in the backdrop.

Suggested Hashtags:

#SBPLoanScheme #PakistanEntrepreneurs #BusinessFinancing #WomenInBusiness #YouthEmpowerment #SMEDevelopment #StartupsPakistan

Latest Updates

Bigger News: BISP 8171 CNIC Check Online 2026 – Eligibility, Payment Status & How to Check

Bigger News: BISP 8171 CNIC Check Online 2026 – Eligibility, Payment Status & How to Check Good News: How to Apply for Green Tractor Scheme Phase 3? New Registration Portal 2026

Good News: How to Apply for Green Tractor Scheme Phase 3? New Registration Portal 2026 Punjab Schools Winter Vacations Update 2026 – Exact Dates & Reopening Schedule

Punjab Schools Winter Vacations Update 2026 – Exact Dates & Reopening Schedule Gold Rate Today – Latest Gold Prices on 11 February 2026

Gold Rate Today – Latest Gold Prices on 11 February 2026 CM Punjab Bike Scheme 2026 Phase 2 Online Registration and Monthly Installment Plan

CM Punjab Bike Scheme 2026 Phase 2 Online Registration and Monthly Installment Plan NADRA Smart ID Card 2026 – New Fees and Fast-Track Delivery

NADRA Smart ID Card 2026 – New Fees and Fast-Track Delivery